A low payout ratio indicates that a company retains ample profits to reinvest for growth while maintaining a comfortable cushion to continue dividend payments. Companies with stable earnings and strong cash flows typically exhibit a more predictable and steadily increasing dividend growth, which can be more sustainable in the long term. For investors, it helps assess the potential income generated from investing in dividend-paying stocks and indicates a company’s commitment to sharing profits.

Why Is the Dividend Payout Ratio Important?

It is important for investors because it provides insights into a company’s dividend policy, financial health, and growth potential, allowing them to make informed investment decisions. The payout ratio is a financial metric that shows the proportion of earnings a company pays its shareholders in the form of dividends. It’s expressed as a percentage of the company’s total earnings and is also known as the dividend payout ratio. It’s key in determining the sustainability of a company’s dividend payment program. It’s expressed as a percentage of the company’s total earnings but it can refer to the dividends paid out as a percentage of a company’s cash flow in some cases.

Can dividend payout ratio be more than 100?

Let’s explore the benefits and potential downsides of companies with high and low dividend payout ratios. On one side, it’s like receiving a regular income from your investment, which is appealing if you’re looking for stable returns. A high ratio could indicate that the company is facing financial challenges or isn’t focused on growing its business.

How to Calculate the Dividend Payout Ratio From an Income Statement

This forward-looking strategy can make a backward-looking dividend payout ratio seem bloated, but in actuality the financial situation will be able to support the payout level without a problem. For example, telecommunications giant AT&T (T ) boasted an annual dividend payment of about $1.76 in 2012. A low payout ratio signifies that a company is retaining a higher percentage of its earnings. This is typically an indication of a growing company, as it has the resources to reinvest in the business or pay off debt.

Investors can narrow down their stock investment search by screening, comparing and analyzing the vast universe of dividend-paying stocks. Learn more about dividend stocks, including information about important dividend dates, the advantages of dividend stocks, dividend yield, and much more in our financial education center. A high payout ratio may indicate limited growth opportunities, while a low payout ratio suggests potential for future expansion.

- Such decisions, while potentially disappointing in the short term, might lead to long-term growth and increased share prices.

- From our example, it’s clear that Mature Industries Ltd., with a Dividend Payout Ratio of 50%, distributes a larger portion of its earnings as dividends compared to High-Tech Innovators Inc., which has a payout ratio of 20%.

- It is up to the investor to decide what kind of dividend payout ratio is most attractive to specific investing needs.

- Theoretically, there is no limit to how much a company can pay out as dividends.

Several considerations go into interpreting the dividend payout ratio—most importantly the company’s level of maturity. IN-FLIGHT caterer and ground handler Sats is unlikely to return to paying out 70 to 80 per cent of its earnings, although the quantum of dividend per share will rise in tandem with its profit. InvenTrust Properties’s last dividend of $0.226 per share was on Sep 30, 2024 (ex-date). The annualized dividend payment of $0.89 per share represents a current dividend yield of 2.89%. And finally, whether a dividend payout ratio is “good” or bad “depends” on the intention of the investor. Of course, dividend cuts are not the only change in DPR that can upset the market and reduce a company’s stock price.

To interpret it, you just have to know how to look at it as well as what your priorities are as an investor. For this reason, investors focused on growth stocks may prefer a lower payout ratio. For example, a company with too high a dividend payout ratio or a spiking dividend payout ratio may have an unsustainable dividend and stagnant growth.

When performing analysis across different sectors, it’s crucial to consider that each industry has distinct characteristics that affect the standard payout ratio. High-growth industries, such as technology, often have lower ratios due to reinvestment needs, whereas stable sectors, such as utilities, typically have higher payout ratios. Analysts must compare a company’s payout ratio to the averages within its industry to make a meaningful analysis. This contextual understanding provides an essential backdrop for assessing risk and forecasting the potential for sustained returns to shareholders. The payout ratio is calculated by taking the dividends per share and dividing it by the earnings per share (EPS), with the result typically expressed as a percentage.

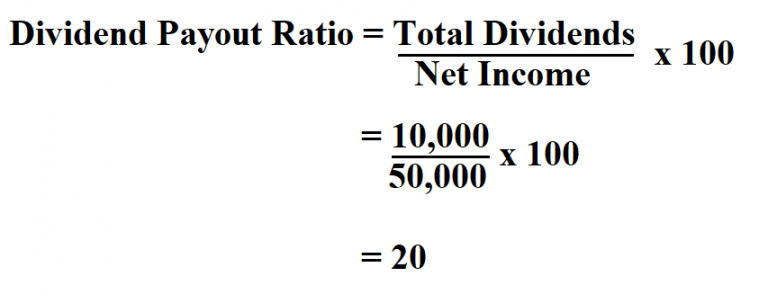

There is no target payout ratio that all companies in all industries and of varying sizes aim for because the metric varies depending on the industry and the maturity of the company in question. In the case of low-growth, dividend companies, investors typically seek some sort of assurance that there’ll be a steady stream of income rather than what is the saver’s credit share price appreciation. The process of forecasting retained earnings for the next four years will require us to multiply the payout ratio assumption by the net income amount in the coinciding period. To interpret the ratio we just calculated, the company made the decision to payout 20% of its net earnings to its shareholders via dividends.

It shows to prospective investors and shareholders that the company is making sound financial decisions. It is one of the reasons why companies are stubborn to cut their dividend, as doing so signals that management has not been able to run the company efficiently. As a result, investors can lose faith in the company, sinking the price of the stock even further. The payout ratio serves as a vital financial metric for investors, enabling them to gain insights into a company’s dividend policy, financial health, and growth potential.

Learn more about planning and maintaining a happy, financially secure retirement. The data for S&P 500 is taken from a 2006 Eaton Vance post.[2] The payout rate has gradually declined from 90% of operating earnings in 1940s to about 30% in recent years. But one concern regarding the introduction of corporate dividend issuance programs is that once implemented, dividends are rarely reduced (or discontinued).